Union director Bhairavi Desai, behind the lectern, announced the hunger strike on Oct. 18. To the right, taxi driver Richard Chow can be seen holding a “Torturing Local Cabbies” sign.

Richard Chow has been among the dozens of yellow cab drivers protesting for Mayor Bill de Blasio’s attention outside City Hall over the past month. At 63, Chow still drives 12-hour shifts daily to pay down the debt he took on in 2006 to buy a taxi medallion, the license required to operate a taxi in New York City.

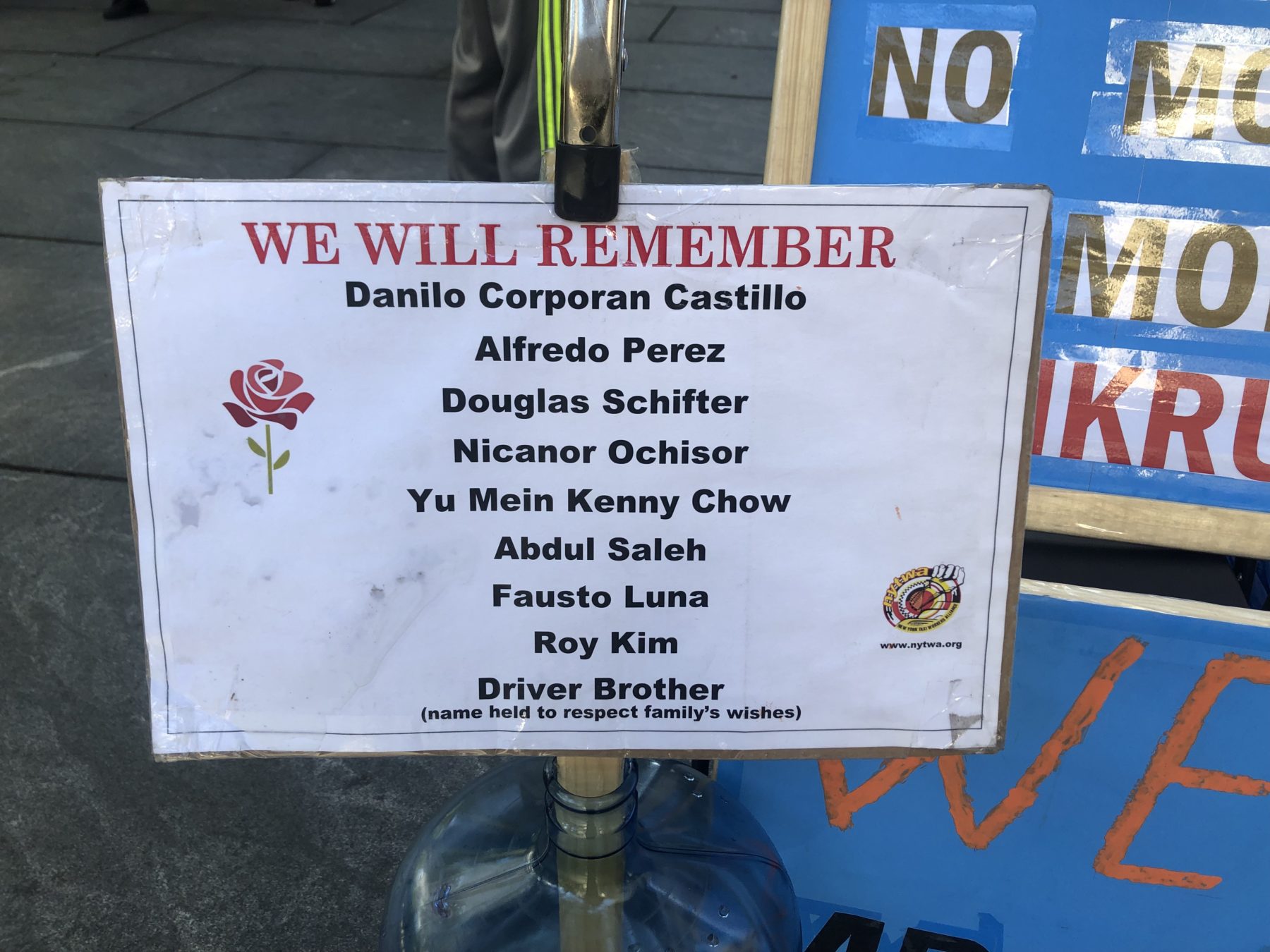

But Chow’s motives go beyond those of the other drivers, because he’s also seeking a measure of justice for his brother, Yu Mein “Kenny” Chow, one of nine taxi drivers who committed suicide in 2018 amid towering medallion debt.

The Chow brothers, immigrants from Myanmar, came to New York in 1987. Richard started driving yellow cabs in 2005, and won his medallion at a city auction the following year with a bid of $410,000. Three years later, Kenny bought his for $700,000. By 2014, the licenses were going for over $1 million.

The medallions were a symbol of the American dream for the Chow brothers and many of the drivers who bought them, a working-class group made up of 95% immigrants. They had no way of knowing that the golden tickets they thought they were buying were part of the largest speculative bubble since the 2007 housing crisis.

New York Taxi Workers Alliance, a union of 25,000 members, has been protesting outside City Hall since Sept. 19. Drivers and union supporters come in shifts to show solidarity for the 24-hour demonstrations, demanding a relief plan which would substantially reduce their medallion debts. On Oct. 20, over 30 taxi drivers have committed to a hunger strike to protest the city’s approved medallion debt relief plan, with a dozen being on an indefinite strike. De Blasio’s office did not return multiple requests for comment.

Among the strikers is Chow. Despite having diabetes and high blood pressure, conditions which require him to take medication with a full stomach, he said he has no choice but to strike.

“I’m not just fighting for myself. This is for the thousands of medallion owners and their families,” he said. “I don’t want to see another suicide like my brother.”

According to a survey by the Taxi and Limousine Commission, owner-drivers owed an average of $499,000 in medallion debt in 2019. However medallion sales, the majority of which were of foreclosed medallions, brought an average of just $117,000 in September of this year, according to TLC data.

“How can I retire? Even if I die, I cannot finish the mortgage,” said Chow. The average yellow cab driver is 50 years of age.

Why did the medallion market collapse? A combination of predatory lending and competition from application-based ride hailing platforms. As Uber and Lyft entered the market, yellow cabs could no longer compete. Uber arrived in 2011, three years after Kenny Chow bought his medallion. Values began to collapse three years after that, according to a 2019 investigation by The New York Times.

There were almost 80,000 app-based for-hire cars in New York in 2020, according to a TLC Factbook, whereas the number of taxis has been capped at about 13,500 for decades.

According to a 2019 broker investigation and medallion-owner surveys by Taxi and Limousine Commission, Department of Consumer and Worker Protection and Department of Finance, half of the drivers said they struggled to pay bills, and 26 percent said they were considering bankruptcy.

Burdened by his debts and harassed by creditors, Kenny Chow, a Queens resident, committed suicide in May 2018 near Gracie Mansion, the mayor’s traditional residence. His body was found floating in the East River 12 days after he was reported missing. He was 56.

Drivers were already clamoring for assistance then, but it has taken until now for authorities to act. On Oct. 6, the city’s Taxi and Limousine Commission approved a plan it said could offer relief to the beleaguered drivers. The $65 million program offers up to $20,000 in grants to medallion lenders who agree to refinance medallion debts and forgive 20 to 40 percent of what’s owed. It also offers another $9,000 to help eligible drivers make loan payments. But the Taxi Workers Alliance deems the proposal insufficient, saying lenders won’t forgive hundreds of thousands of dollars in debt in exchange for just $20,000 per loan.

In a Sept. 27 TLC public hearing before the plan was approved, over a dozen taxi drivers, including Chow, were joined by state Sen. Jessica Ramos and state Assemblyman Zohran Mamdani in testifying against the proposed debt relief program.

Union Executive Director Bhairavi Desai has dubbed the TLC’s plan a “Band-Aid on a gunshot wound.”

The union has proposed $93 million in debt relief that would restructure each medallion loan at $145,000 and set refinance payments at $800 per month. In this scenario, the city would serve as a guarantor to incentivize lenders.

New York City Comptroller Scott M. Stringer took to Twitter to say that the union’s proposal is “fiscally sound, reduces cost and risk to taxpayers, and can be implemented without delay.”

The union and its allies, including the Democratic Socialists of America, continue to mobilize outside the City Hall, chanting “No justice, No deal!”

Their efforts are gaining some traction. U.S. Senate Majority Leader Chuck Schumer is among those who have signed a letter to the mayor calling for New York City to add a city-backed guarantee to the medallion debt relief plan, which would provide a major incentive for lenders to participate.

“A hunger strike is a last resort, but it’s one many of our drivers are prepared to take because there is simply no acceptable alternative to meaningful debt relief,” said Matthew Thomas, a spokesperson with the Taxi Alliance’s media office.

They have few options left, said Chow, who still owes $389,000 on a medallion he says is now worth about $70,000.

“We lost our investment, our retirement. We lost everything,” he said.

About the author(s)

Inci is a reporter-in-the-making currently pursuing a M.S. degree in Journalism at the Columbia University Graduate School of Journalism.